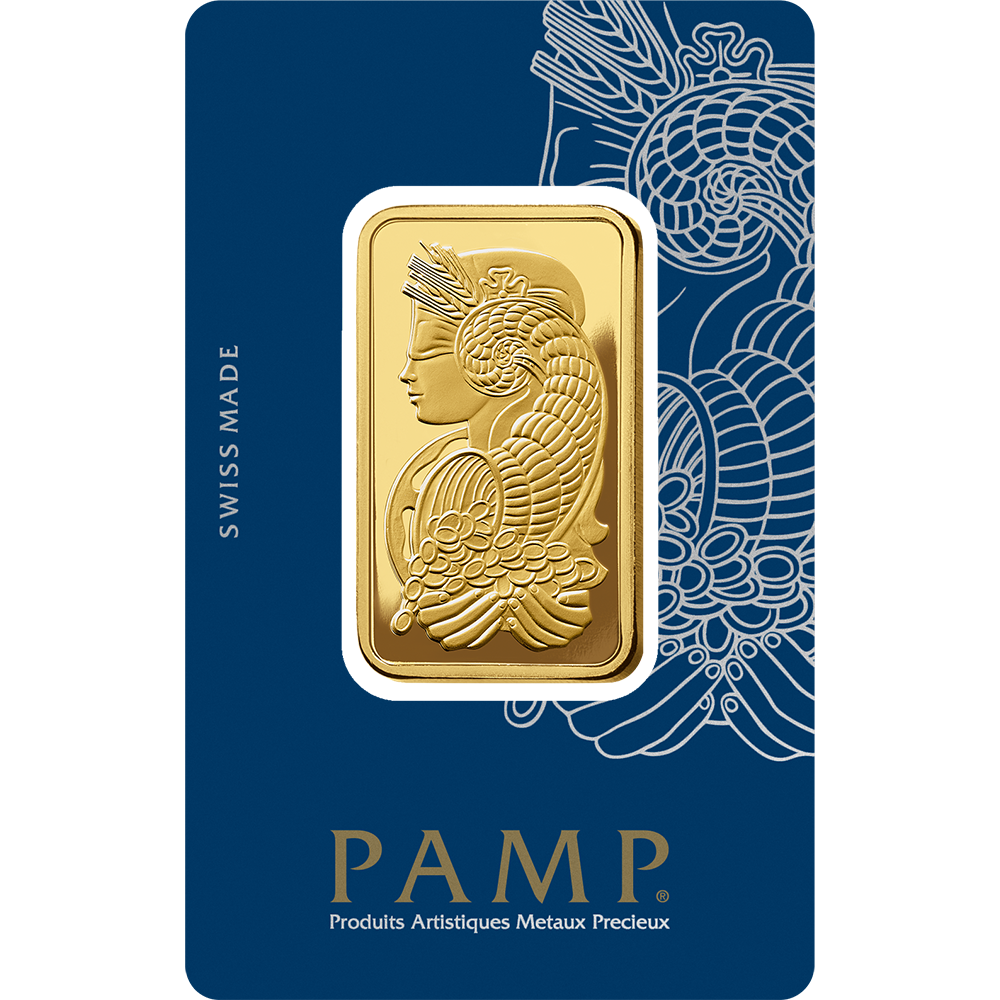

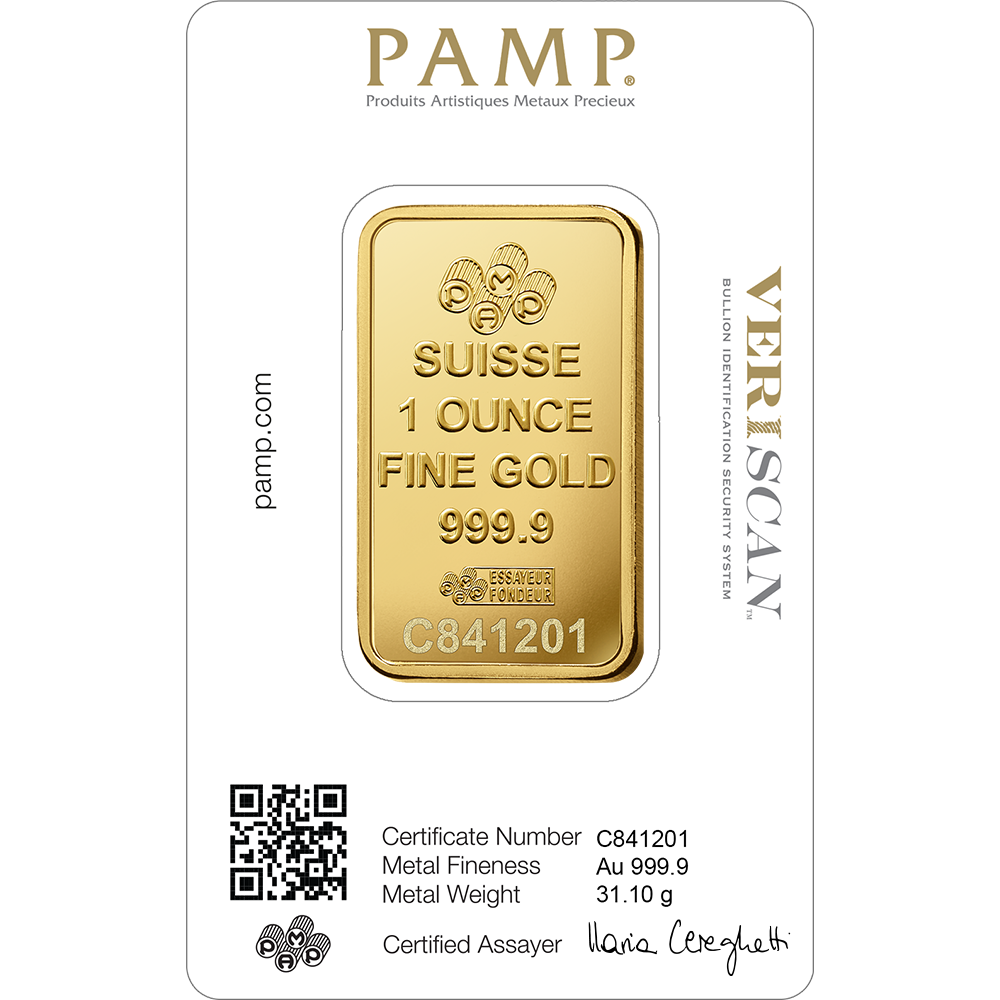

1 oz Gold Minted Bar – PAMP Suisse (Lady Fortuna)

Payment instructions will be provided after order confirmation.

Estimated delivery time: approximately 5–7 business days.

The 1 troy ounce (31.1 g) gold minted bar represents the globally recognized standard unit of physical investment gold. It is produced by PAMP Suisse, a Swiss LBMA-accredited refiner internationally respected for precision manufacturing, consistent quality, and institutional credibility.

This denomination is commonly selected by investors who prefer internationally standardized weights when building or maintaining a structured physical gold position. The one-ounce format ensures straightforward valuation, broad market recognition, and high liquidity across global bullion markets.

Each bar is individually registered and sealed in tamper-evident CertiPAMP™ packaging, allowing verification of authenticity, weight, and purity. The Lady Fortuna design serves as a distinguishing identifier of PAMP’s minted bullion series and does not affect the bar’s bullion status.

Choose options

Details

Investor Guide – Key Information Before You Buy

If you would like to better understand the principles behind buying physical investment gold, the following guides explain the most important topics investors typically consider before making a decision.

These resources are optional, but may help you invest with greater clarity and confidence.

Buying physical investment gold through us is a clear and transparent process designed to give you control at every step.

Each order begins with a non-binding price request. Based on current market conditions and product availability, we will provide you with a price quotation reflecting the gold market price at that moment.

Once the offer is accepted, the order is confirmed and the price is fixed for a defined period. You will then receive bank transfer payment instructions.

After payment is credited, the product is prepared for shipment or personal collection, depending on the selected option. You will be kept informed throughout the process.

What this means for you:

You receive a clear, market-reflective offer without any obligation, allowing you to proceed only when the terms are fully understood and acceptable.

The price of investment gold is directly linked to the international gold market and reflects real-time market conditions.

Once your order is confirmed, the purchase price is fixed for a clearly defined period. This protects you from short-term market movements and ensures that the agreed price remains unchanged while you complete the payment.

To maintain the fixed price, the bank transfer must be initiated within the specified time window after order confirmation. Confirmation of payment initiation is required within this period.

If payment is not initiated within the fixed timeframe and the gold market price changes, the order price will be adjusted to the current market level or the order may be cancelled. This approach ensures that pricing remains fair, transparent, and aligned with the live gold market.

What this means for you:

You are protected from sudden price fluctuations once you confirm your order, while retaining full control over whether and when you proceed with the purchase.

This gold bar is produced in a standardized format that is widely traded across the EU market. Standardization is a key factor in gold liquidity, as it allows the product to be easily recognized and priced according to the current gold market.

Gold purchased from Sosna Gems can be resold through our buyback process. Buyback prices always reflect the prevailing market price of gold at the time of resale, ensuring alignment with real market conditions rather than fixed or artificial pricing.

For buyback, the integrity of the original refinery packaging (blister) is important. An intact and unopened seal confirms authenticity and simplifies resale within the professional gold market. If the original packaging is damaged or opened, the gold remains genuine, but the buyback price may be adjusted to reflect additional verification or handling requirements.

What this means for you:

You own a form of gold that is broadly recognized and liquid, with a clear and transparent resale framework based on market prices rather than discretionary valuation.

Investment gold has a specific legal and tax status within the European Union. Physical gold that meets the criteria of investment-grade bullion is exempt from VAT, making it a recognized and established asset class for long-term investors.

From a legal perspective, purchasing investment gold represents direct ownership of a physical asset. There is no ongoing reporting obligation associated with ownership itself, and holding physical gold does not create any automatic administrative burden.

Tax treatment may vary depending on individual circumstances and jurisdiction, particularly in the case of resale. Any potential tax obligations generally relate only to realized gains and depend on factors such as holding period and local tax regulations.

For most investors, investment gold is valued for its simplicity: it is a tangible asset with a clear legal framework and without complex contractual structures.

What this means for you:

You are investing in a legally established, VAT-exempt asset with a straightforward ownership structure and no hidden administrative complexity.

Payment for investment gold is accepted exclusively by bank transfer. For security and regulatory reasons, the name of the bank account holder must match the name on the order. Third-party payments are not accepted, in line with standard AML requirements applicable to precious metals transactions.

Once payment is received, the order proceeds to fulfillment. All shipments are fully insured and carefully prepared to ensure secure transport. Responsibility for the shipment remains with us until it is successfully delivered to you.

Upon delivery, we recommend inspecting the package integrity in the presence of the courier. If the outer packaging shows visible signs of damage, the shipment should not be accepted and the issue documented immediately. This ensures that any irregularities can be resolved promptly and transparently.

For clients who prefer maximum discretion, personal pickup is available by prior arrangement.

What this means for you:

Your payment and delivery are handled under clear, professional standards, with full insurance coverage and responsibility maintained until the gold is safely in your possession.

Physical investment gold can be stored in several ways, depending on your preferences for accessibility, security, and privacy. There is no single “correct” solution — the right option depends on how you plan to hold and use your gold over time.

Some investors choose to store gold personally, maintaining direct access at all times. Others prefer professional storage solutions that offer a higher level of security and reduced personal responsibility.

We can arrange secure storage of your investment gold on your behalf. Gold is held in professional, high-security vaults designed specifically for precious metals. Storage solutions can be arranged globally, depending on individual requirements and preferences. Detailed information is provided upon request, allowing each client to choose the setup that best fits their situation.

Regardless of the chosen option, the key principle remains the same: your gold remains fully allocated and owned by you at all times.

What this means for you:

You are free to choose how and where your gold is stored — whether personally or through professional vaulting — with flexible, secure options available when needed.

Exposure to gold can be achieved in different ways. Some investors hold physical gold directly, while others gain exposure through financial instruments such as ETFs, certificates, or derivatives linked to the gold price.

Physical investment gold represents direct ownership of a tangible asset. It exists independently of the financial system and does not rely on any intermediary, issuer, or counterparty. Its value is derived from the metal itself, not from a contractual claim.

Paper-based gold products may offer convenience or short-term trading flexibility, but they typically represent a financial claim rather than physical ownership. Their performance and accessibility can depend on market conditions, counterparties, and the structure of the specific instrument.

For investors focused on long-term wealth protection, physical gold is often chosen for its simplicity, transparency, and independence. It is not intended for speculation, but for holding value across different economic environments.

What this means for you:

By choosing physical investment gold, you own a tangible asset outright, without reliance on financial intermediaries or complex financial structures.