How to start with investment gold

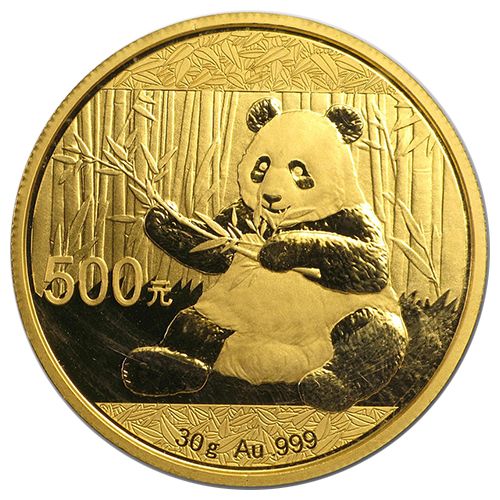

Gold Coins

Globally recognized investment coins. Suitable for flexible holding and gradual resale.

View gold coins

Gold of the Emirates

A rare segment of investment gold, discreetly distributed through global trading hubs.

View the Emirates CollectionOur Recommended Starting Point

The most common first gold purchase among our clients. A clear, liquid, and widely accepted standard.

- One of the most liquid gold formats on the EU market

- Low premium over spot price

- VAT-exempt investment gold

- Eligible for future buyback

Description

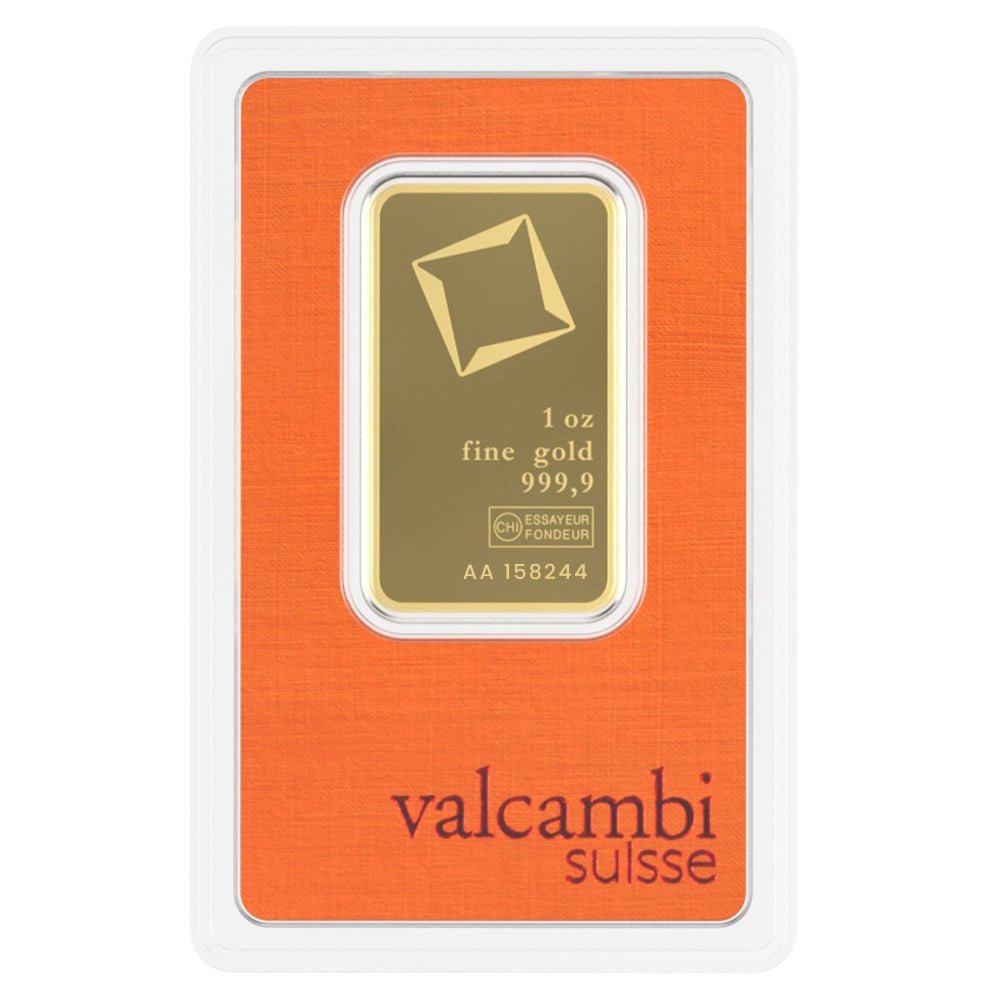

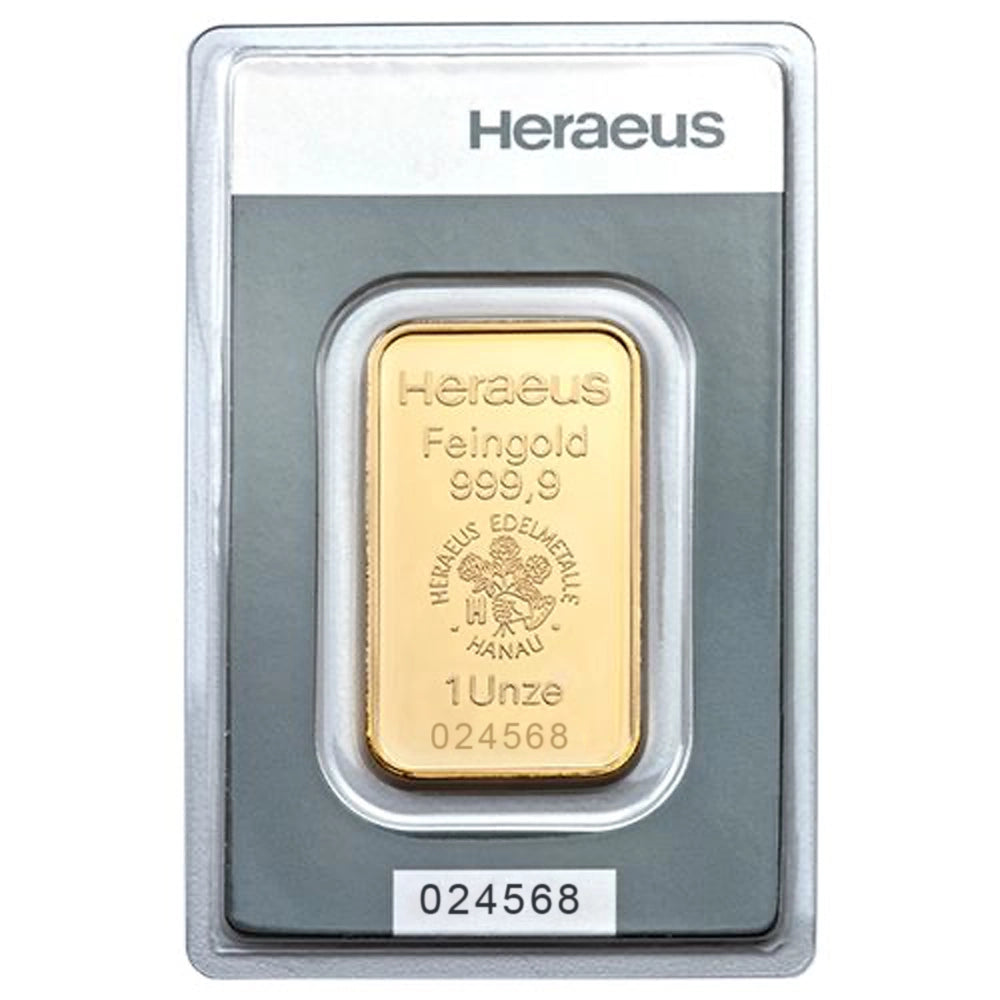

This 1 oz gold bar represents a widely recognized entry standard for both first-time and long-term gold investors.

- Weight: 1 oz

- Purity: 999.9 / 24k

- Manufacturer: Argor Heraeus (LBMA)

- Form: Sealed investment bar

Suitable as a first gold allocation

Liquidity and resale options

Physical gold is valued not only for ownership, but for its liquidity.

Our curated selection focuses on standardized bars and coins that remain widely tradable over time.

- EU-recognized standards – LBMA-certified bars and widely traded coins

- Market-based pricing – Buyback prices reflect current gold market conditions

- Long-term partner – Support from purchase to future resale

Note: Resale prices always reflect the current market price of gold at the time of sale.

How buying investment gold works

Tax treatment of investment gold

Investment gold that meets defined legal criteria is exempt from VAT under EU regulations, making it one of the most tax-efficient ways to hold physical assets.

All gold bars and coins in this selection qualify as investment gold under Czech law and fully comply with applicable EU and national regulations.

This ensures transparent pricing, legal certainty, and a clear distinction between investment gold and standard retail products.

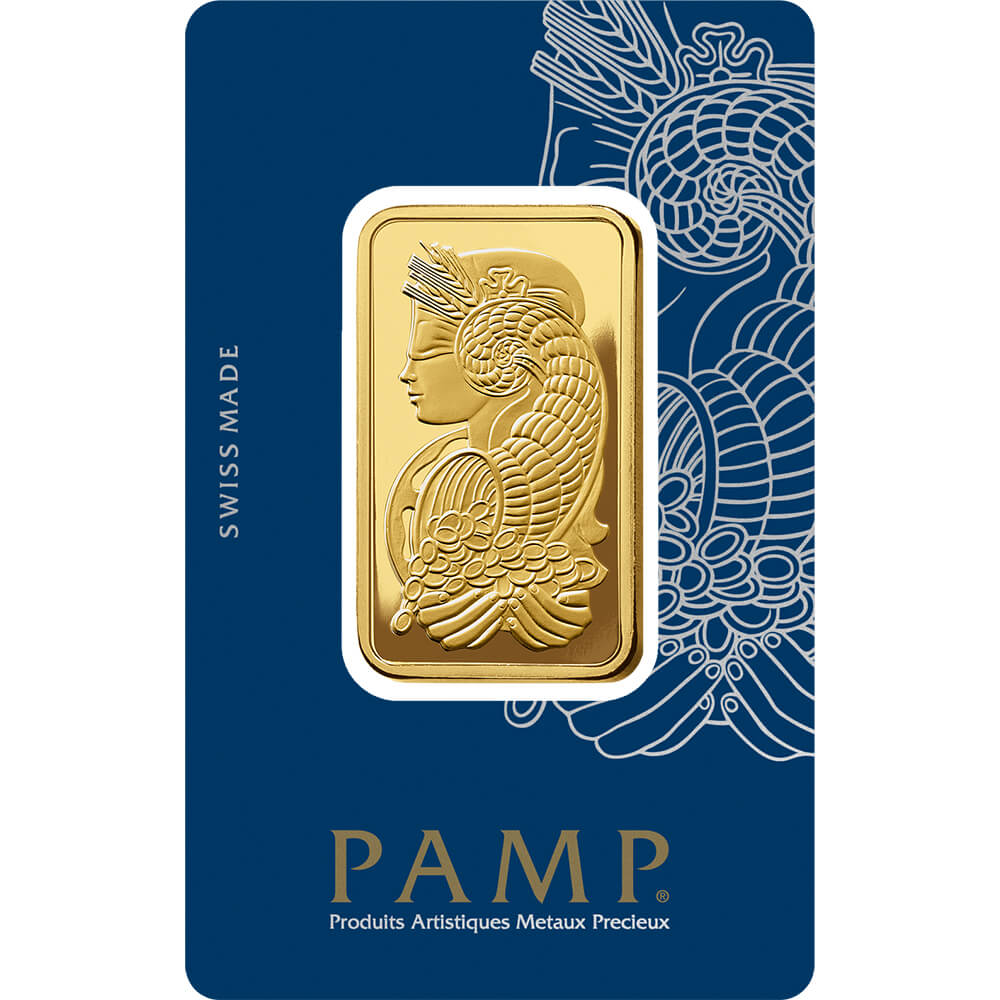

Sourced from trusted refineries

We work exclusively with gold bars and coins produced by LBMA-certified refineries and internationally recognized mints, ensuring consistent purity, authenticity, and long-term market acceptance.

Our selection includes products from established producers such as Argor-Heraeus, PAMP, and Münze Österreich.

Private consultation for larger gold purchases

Purchasing a larger amount of physical gold is a significant decision.

If you are considering higher-value orders or have specific requirements, our concierge service offers a discreet and personal approach.

We provide individual consultation for clients who prefer to discuss logistics, pricing structure, delivery options, or portfolio allocation before proceeding.

This service is suitable for:

- Larger gold purchases (typically 250 g and above)

- Clients seeking tailored delivery or storage arrangements

- Investors who value clarity before execution

No obligation. Fully confidential.