Ruby as an Investment-Grade Gemstone

Investment-grade rubies represent the apex of the colored gemstone market, defined by extreme rarity, historical significance, and sustained global demand. Among all colored gemstones, rubies have consistently demonstrated exceptional value retention, particularly when strict criteria of color, origin, and treatment are met.

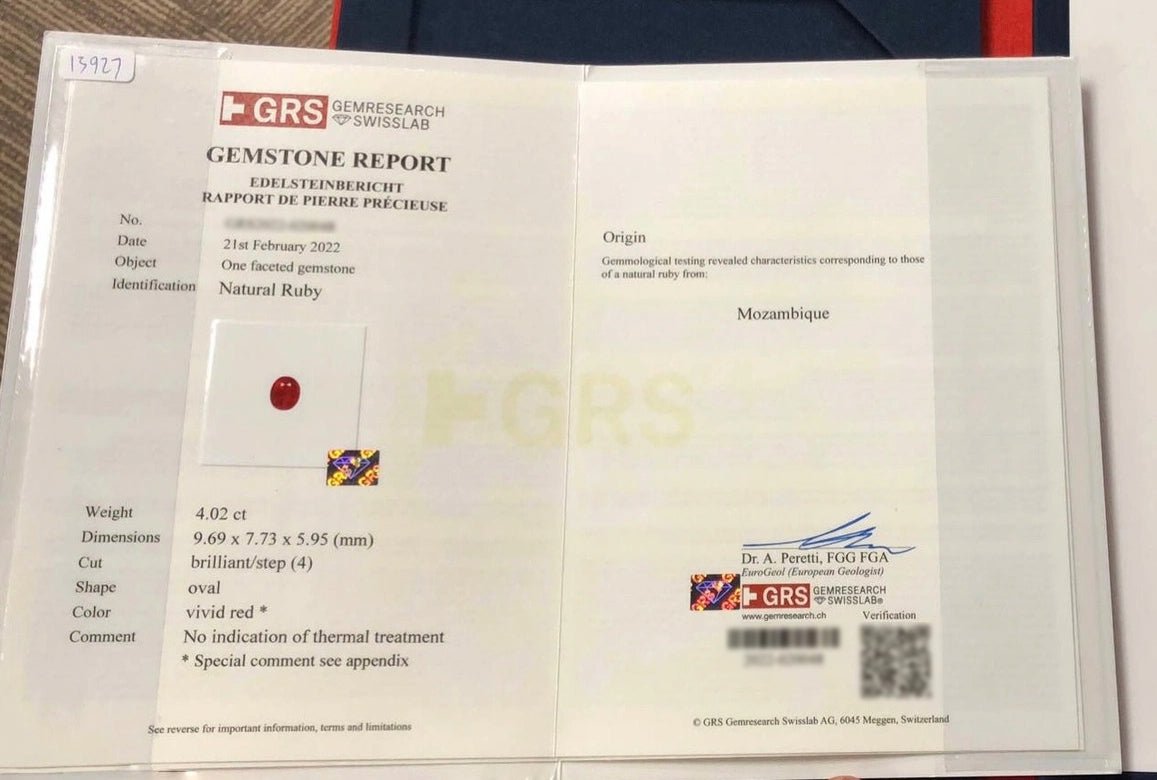

The most sought-after specimens are characterized by an intense, vivid red hue commonly described as “pigeon blood,” a narrowly defined saturation associated with exceptional fluorescence and visual depth. From an origin perspective, the market places the highest emphasis on historic Burmese (Myanmar) rubies, alongside select high-quality material from the Montepuez region of Mozambique, which has emerged as a modern source of investment-grade stones.

Color, Origin, and Natural Integrity

Color remains the single most influential factor in ruby valuation. Investment-grade stones exhibit a balanced red saturation without excessive darkness or secondary tones, allowing the gemstone to retain brilliance across varying light conditions. Origin further reinforces market perception, with certain localities recognized for producing rubies of superior crystalline structure and chromatic intensity.

Natural integrity is equally critical. Rubies suitable for long-term investment are selected not only for visual impact, but for the inherent quality of the original crystal, which directly influences durability, rarity, and desirability within the global market.

The Significance of Unheated Rubies

Within the professional investment segment, the absence of thermal enhancement represents a decisive value factor. While heat treatment is widely accepted in the commercial gemstone trade, unheated rubies of notable size and quality are geological exceptions.

Only a minute fraction of mined rubies possess sufficient natural color and clarity without human intervention. These unheated stones command a substantial premium due to their scarcity, documented authenticity, and stronger long-term positioning as natural assets.

Certification, Liquidity, and Long-Term Perspective

Given the high value concentration of investment-grade rubies, independent gemological certification is essential. Documentation from internationally recognized laboratories verifies natural origin, treatment status, and key quality characteristics, forming the foundation of market transparency and global liquidity.

Rubies are typically approached as long-term tangible assets rather than short-term speculative instruments. Diminishing availability of top-quality rough material, combined with sustained international demand, reinforces their role as a disciplined alternative investment for informed collectors and investors.