Tanzanite as an Investment-Grade Gemstone

Investment-grade tanzanite represents one of the most geographically constrained colored gemstones available on the global market. Its origin is limited exclusively to a single mining area in the Merelani Hills of northern Tanzania, with no alternative deposits known worldwide. This strictly finite supply forms the structural foundation of tanzanite’s long-term investment profile.

As production volumes from the Merelani region continue to decline, high-quality material has become increasingly selective. Stones suitable for investment purposes are defined not by availability, but by rarity within rarity, where only a narrow segment of mined tanzanite meets the required standards of color, clarity, and overall quality.

Quality Parameters and Market Selection

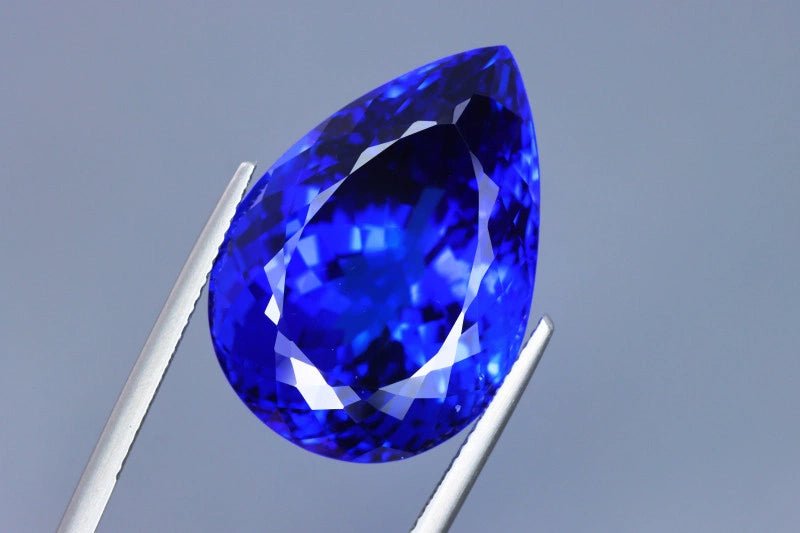

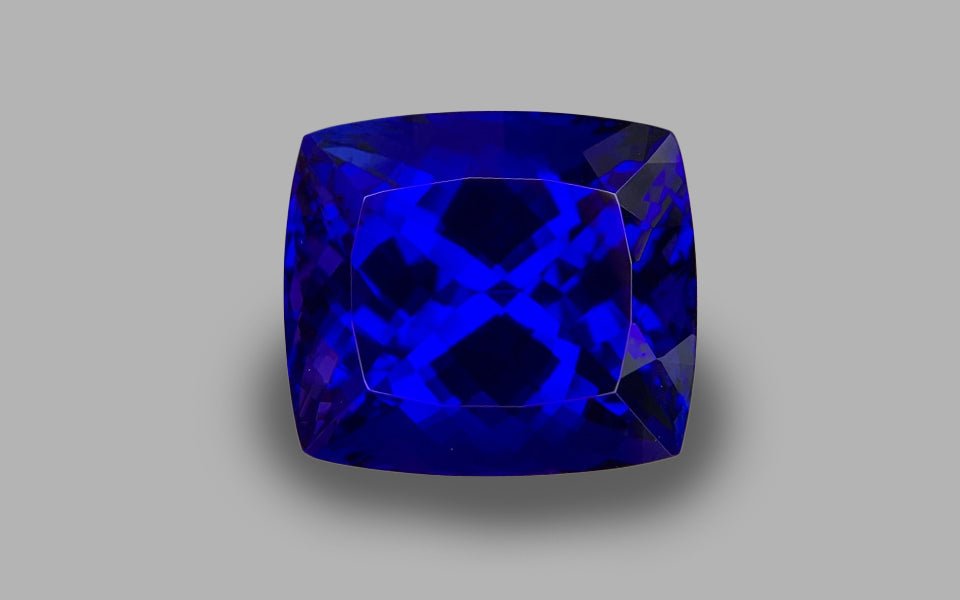

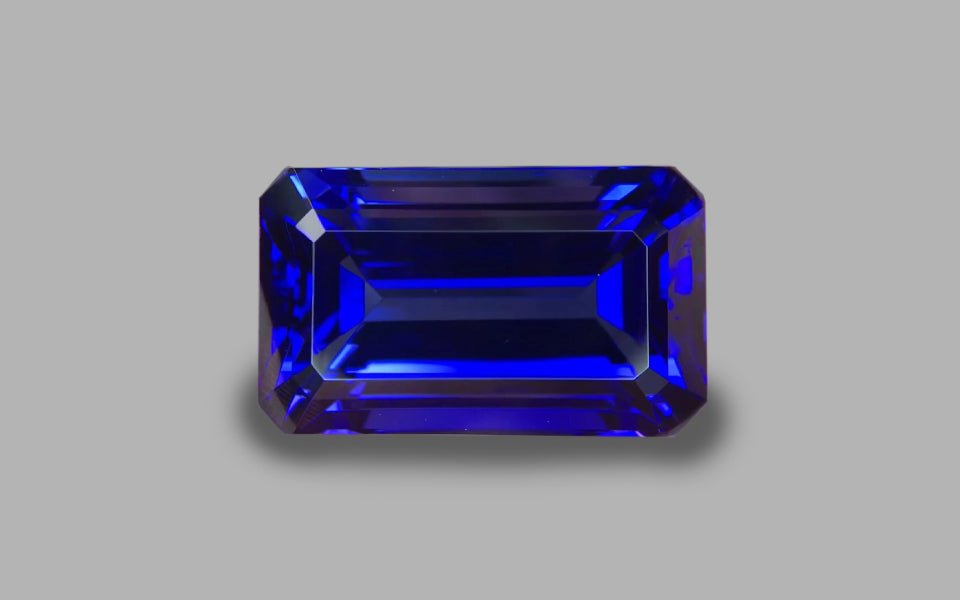

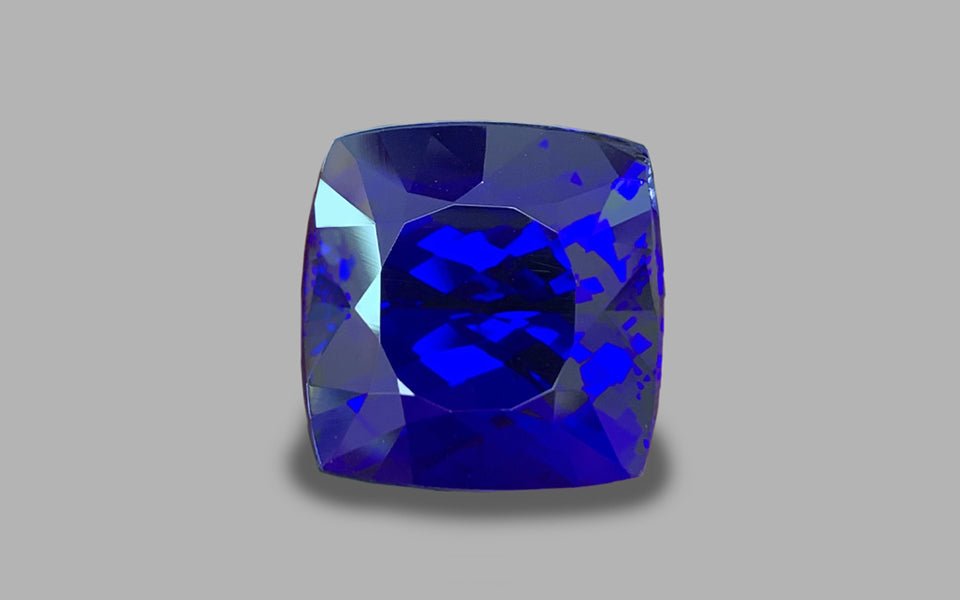

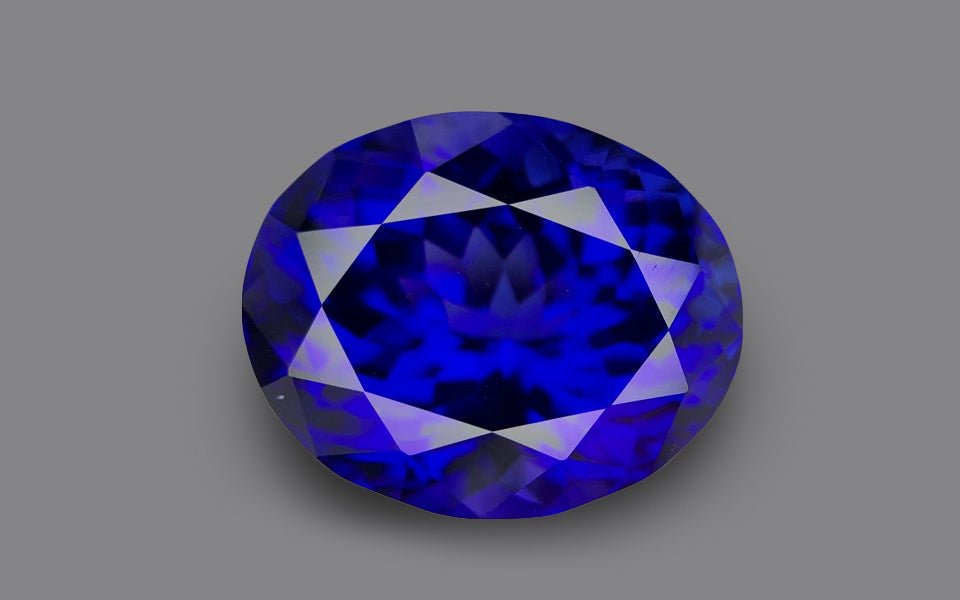

From an investment perspective, tanzanite is evaluated primarily through color saturation, optical purity, and cutting precision. Investment-grade specimens typically display vivid blue to blue-violet hues with strong pleochroism, offering visual depth and chromatic complexity that distinguish them from commercial-grade material.

Clarity plays a decisive role in long-term value retention. Stones selected for this category demonstrate exceptional transparency, allowing light to pass cleanly through the crystal structure without disruptive inclusions. Precision cutting further enhances brilliance while preserving carat weight, an important factor in market liquidity for larger stones.

Certification, Treatment Disclosure, and Market Transparency

Transparency is fundamental in the high-value gemstone market. While gentle heat treatment is an industry-accepted and widely documented process used to reveal tanzanite’s characteristic color, investment relevance is determined by the quality of the original rough material rather than the presence of treatment alone.

Each gemstone within this curated selection is accompanied by independent gemological certification, documenting natural origin, disclosed treatment, and key quality parameters. Such verification establishes confidence, supports market comparability, and reinforces the stone’s position within the investment-grade segment.

Strategic Considerations for Long-Term Holding

Tanzanite is typically approached as a long-term tangible asset rather than a short-term speculative instrument. Its portability, durability, and increasing international recognition position it within the broader category of alternative hard assets sought by informed investors.

Due to its finite geological supply and selective quality thresholds, investment-grade tanzanite remains relevant primarily to buyers who prioritize documented quality, disciplined selection, and a long-term perspective on scarcity-driven value.